Investment Planning

What is Investment Planning?

Investment planning is the process of determining one's financial objectives and turning them into a plan. The core of financial planning is investment planning. Identifying goals and objectives is the first step in investment planning. Then, we must balance those objectives with the financial resources at our disposal. There are numerous investment vehicles available today, with cash, shares, bonds, and real estate being the most popular. In order to achieve our aims and objectives, we can invest in these vehicles based on the funds we have available.

Benefits of Investment Planning

The importance and benefits of investment planning are stated below:

•Family Security: Planning your investments is crucial for the security of your family. The family's investment will ensure the financial security of the other members even in the event that something was to happen to the working member.

•Efficiently manage income: An investing plan can be used to effectively manage a person's income and expenses. Controlling income enables one to control other expenses, tax obligations, etc.

•Financial Understanding: Planning your investments might help you better comprehend your financial status. Financial knowledge makes it simple for someone to assess investments or retirement plans.

•Savings: Investments: should be made in highly liquid investment instruments. In an emergency, money can be easily withdrawn from those investments.

•Standard of Living: In difficult times, the savings produced by the investment are quite beneficial. For instance, the death of the family's breadwinner significantly impacts the living level. At that point, the working person's investment serves as a valuable source of income for the family.

Objectives of Investment Planning

•Safety: Also, one should put money into secure investment instruments. Money market investments are safer than bond market investments.

•Income: We must invest in higher-risk investment vehicles in order to earn a larger income in order to benefit from them. To benefit from return maximization, investors must do a thorough analysis, assess their risk-return ratio, and invest appropriately in the right asset classes. Thus, careful investment planning is crucial.

•Growth of Capital: The difference between a capital gain and a return is that a capital gain can only be realized when the security is sold for more money than it cost to buy it in the first place. Capital loss results from selling at a loss. Thus, investors who desire capital gains should make longer-term investments in securities.

•Tax Minimization: As part of his investing strategy, an investor may choose to make those investments in order to minimize taxes. A wealthy businessman, for instance, could desire to look for investments that have favorable tax income in order to lower taxes.

•Liquidity: Many investments are liquid, meaning that it is simple to turn them into cash. Yet giving up a certain amount of revenue is necessary to reach this level of liquidity.

How to create a solid investment plan?

A sound investment plan is necessary before investing in any type of investment instrument. All of our investments will end up in a mess if we don't plan. Prior to investing, planning is a crucial step.

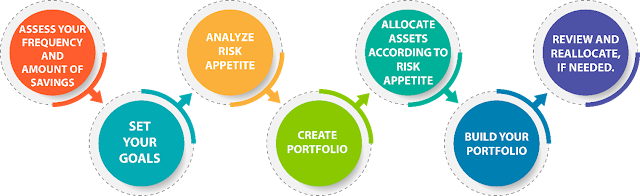

The investment planning steps are as follows:

Comments

Post a Comment